Institute of Advanced Industry: China's lithium battery shipments 2023Q3

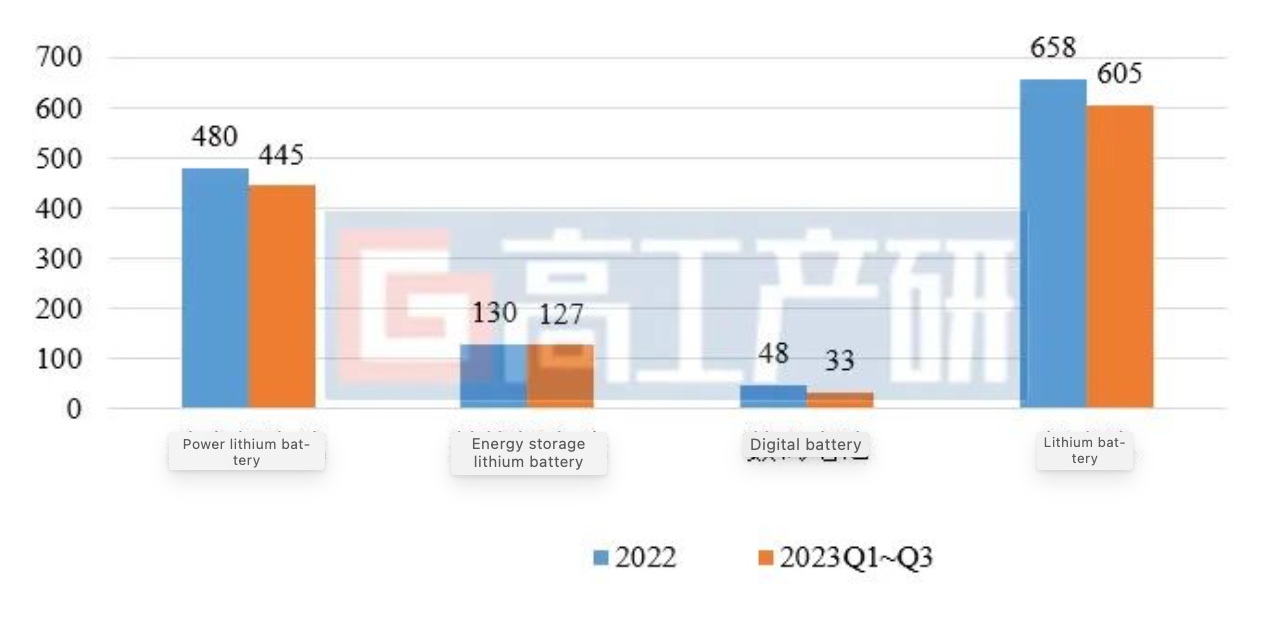

According to Shanghai Securities News (Reporter Wang Yuqing), the Institute of Technology Lithium that according to the research data of the Institute of Advanced Industry (GGII) in the third quarter, China's lithium battery shipments in the first three quarter of 2023 were 605GWh, an increase of 34% year-on-year, which is close to the full-year level of 2022. Among them, power battery shipments were 445GWh, an increase of 35% year-on-year; energy storage lithium battery shipments were 127GWh, an increase of 44% year-on-year; digital battery shipments were 33GWh, a year-on-year decrease of about 6%.

Picture 2022-2023Q1~Q3 China Lithium Battery Shipment (GWh) Source: High-Gong Lithium

In terms of power batteries, GGII analyzed that the year-on-year growth rate of 35% of power battery shipments in the first three quarters declined significantly compared with the same period last year. According to the data of the China Automobile Association, from January to September 2023, the sales volume of new energy vehicles in China was 6.278 million, an increase of 37.5% year-on-year. GGII believes that there are two main reasons why the growth rate of power battery shipments is lower than the sales growth rate of new energy vehicles: first, the domestic plug-in hybrid new energy vehicles accounted for 7 percentage points in the first three quarter, while the number of plug-in hybrid bicycles is about 30kWh less than that of pure electric vehicles; second, Inventory at the price of high lithium salt has surged. GGII data shows that the inventory of lithium batteries reached 130-150GWh in the first half of 2023.

In terms of energy storage batteries, driven by the growth of the electric energy storage and industrial and commercial energy storage markets, China's energy storage lithium battery shipments in the first three quarter of 2023 were 127GWh, an increase of 44% year-on-year. Among them, shipments in the third quarter were about 40GWh, down more than 10% month-on-month. The main reason is that the installation of U.S. power storage has been delayed, and the demand in overseas markets has weakened. Second, domestic lithium salt prices have continued to decline, and end customers are more cautious in placing orders to reduce losses.

In terms of digital batteries, the consumer demand for major 3C digital products was relatively weak in the first three quarters, resulting in a decline in shipments in the 3C soft package digital, electric tools and lithium two-wheelers market.

In terms of battery cathode materials, GGII data shows that in the first three quarters of 2023, China's shipments of cathode materials was 1.82 million tons, an increase of 40% year-on-year. Among them, 1.2 million tons of lithium iron phosphate, 487,000 tons of ternary materials, 60,000 tons of lithium cobaltate materials, and 75,000 tons of lithium manganate materials, with year-on-year increases of 64%, 6%, 1.7% and 50% respectively. In the first three quarters, lithium iron phosphate batteries accounted for more than 70%, driving the rapid growth of shipments of lithium iron phosphate cathode materials. However, GGII data shows that the growth rate of ternary has exceeded that of iron and lithium in September, and the proportion of ternary positive materials is expected to rise in the fourth quarter. In addition, the decline in the price of lithium salt has also increased the cost performance of lithium manganate materials. Some domestic 3C products began to switch from lithium cobaltate to lithium manganate routes, driving the shipments of lithium manganate materials to increase by 50% year-on-year. GGII expects that lithium manganate materials will continue to grow rapidly in the fourth quarter.

GGII concluded that all links of China's lithium battery industry chain still maintained a rapid growth momentum in the first three quarters, but the growth rate decreased significantly compared with the same period last year. With the arrival of the peak market demand season in the fourth quarter and the gradual stabilization of material prices in various links, the overall situation of the industry is expected to improve in the fourth quarter. GGII expects that China's annual lithium battery shipments are expected to achieve a growth rate of about 35%.